Post

Increase in advertising investment

Advertising investments in Central and Eastern Europe have optimistically increased following the COVID-19 pandemic

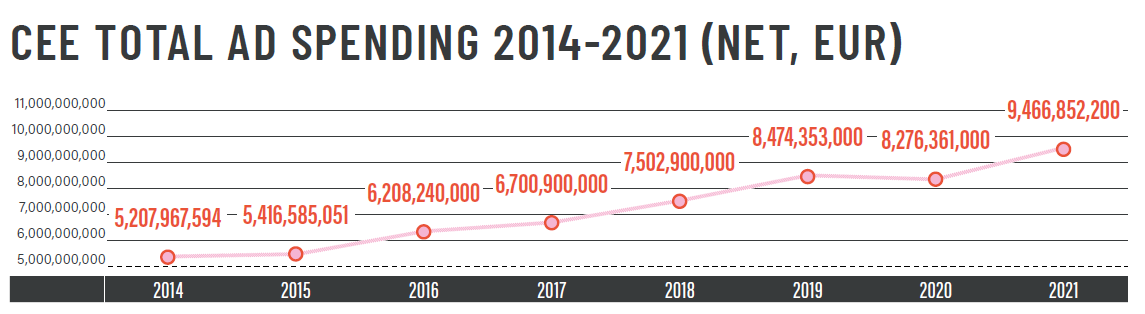

The advertising market in Central and Eastern Europe has already surpassed pre-pandemic levels, reaching a value of €9.5 billion in 2021. Advertisers significantly increased investments

in online advertising, driven by the rapid growth of e-commerce. Numerous new consumer trends can also be observed across the region.

The Polish section of the report was prepared by MEDIA PEOPLE, which, in addition to Polish consumer trends, included dedicated insights on the opportunities for TikTok in the Polish market.

weCAN, the network of independent advertising agencies of Central and Eastern Europerecently published its 8th annual report called CANnual Report. The report features the detailed analysis of advertising markets in 14 Central and Eastern European countries with focus on the effects of the COVID-19 pandemic in them. Besides compiling extensive data on the development of CEE’s media markets over the past year, weCAN experts provide with an overview of the most prominent topics in communications that shape advertising in the region.

The report includes an article by guest author Dr. Árpád Rab, an expert of digital culture and a futurologist who describes from a historical viewpoint the impact of digital technologies on our lives, and how they will influence them in the next decade.

Top 5 micro-consumer trends in Polish communication featured in the CANual 2021 report

The authors of the Polish section of the report included the most important consumer trends in their publication.

1. Customer-Centricity and Community Building

This is a highly popular trend in communication with multiple target groups. It is especially visible in community building with Generation Z and highly specific groups gathered around shared needs or challenges, such as caregivers of elderly or disabled people, or individuals following specialised diets.

2. Climate Issues

More and more brands are addressing climate-related topics in their communication. They tend to act within areas where they have real impact and leadership, such as circular fashion, water protection, and endangered species conservation. Unfortunately, greenwashing campaigns are still common in the Polish market.

3. The Renaissance of the Subscription Model

During the pandemic, free content flooded the Polish internet. This helped consumers realise the value of high-quality, curated content — and today they are finally ready to pay for it. Subscription models have expanded into new consumer categories. People order groceries for home delivery, buy contact lenses (Vision Express), razors (Estrid), dog food (Piesotto), and intimate hygiene products and sanitary pads (Your Kaya). For comfort and convenience, consumers subscribe to essential products so their only concern is receiving a monthly package.

4. Family Defined by Emotion, Not Formal Status

For many years, Poles believed that “family” meant a married man and woman with children. The latest research presented by Ringier Axel Springer shows that “family” is now defined by emotional bonds between people. This may include patchwork families, same-sex relationships, or even, for 11% of Poles, individuals who are not in a romantic relationship but share strong bonds with their pets.

5. Rural Homes and Hotels – Flower Power and Nature Therapy

The pandemic changed how people view life, work, and leisure. Many city dwellers working in offices returned to their hometowns, moved to rural areas, or decided to rent or buy houses outside big cities. Poles realised the importance of daily contact with nature. This trend is reflected in the strong growth of home décor and plant sales.

TikTok in Poland Is Growing Fast

Media People also highlighted the rapidly increasing importance of TikTok in the Polish market.

– Central Europe, including Poland, is the fastest-growing TikTok market. The Chinese platform has been present in Poland for over two years and has been growing steadily since. More and more marketers are including TikTok in their media plans to reach younger audiences, track engagement, and influence purchasing decisions. With 13 million real users (according to Gemius), TikTok is currently the third most popular social media platform in Poland, after Facebook and Instagram.

In some target groups, TikTok is starting to act as a search engine for content and advice, posing a potential future threat to Google and YouTube — says Weronika Szwarc-Bronikowska, Vice President of MEDIA PEOPLE and co-author of the CANual Report 2021. says Weronika Szwarc-Bronikowska, Vice President of MEDIA PEOPLE and co-author of the CANual Report 2021.

Market Recovery After the Pandemic

The year 2021 marked a period of economic recovery. Growing household consumption, rising wages and decreasing unemployment resulted in an average GDP growth of 6%. The political situation did not deteriorate according to the Democracy Index: the average score for 14 Central and Eastern European countries increased from 6.73 to 6.75. By comparison, the global Democracy Index score declined from 5.37 in 2020 to 5.28 in 2021.

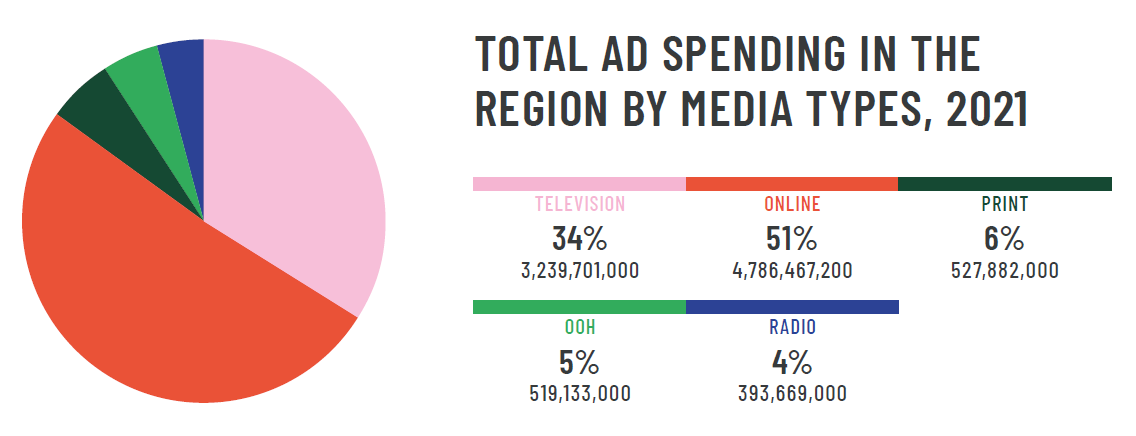

Amid favourable conditions in 2021, the advertising industry more than recovered the 2% loss suffered during the 2020 pandemic. The CEE market reached a net volume of €9.5 billion, with a 14% year-on-year growth in 2021. he main beneficiary was the digital advertising segment, which recorded an 18% increase, capturing more than half of total advertising investment on a year-on-year basis.

Although advertising investments increased across all major segments, the average media channel share has remained largely stable. Online media continue to strengthen. Television still holds a very strong position, although it is slowly losing share year by year. Print media has shown a slight upward trend, while out-of-home and radio advertising segments have maintained their positions.

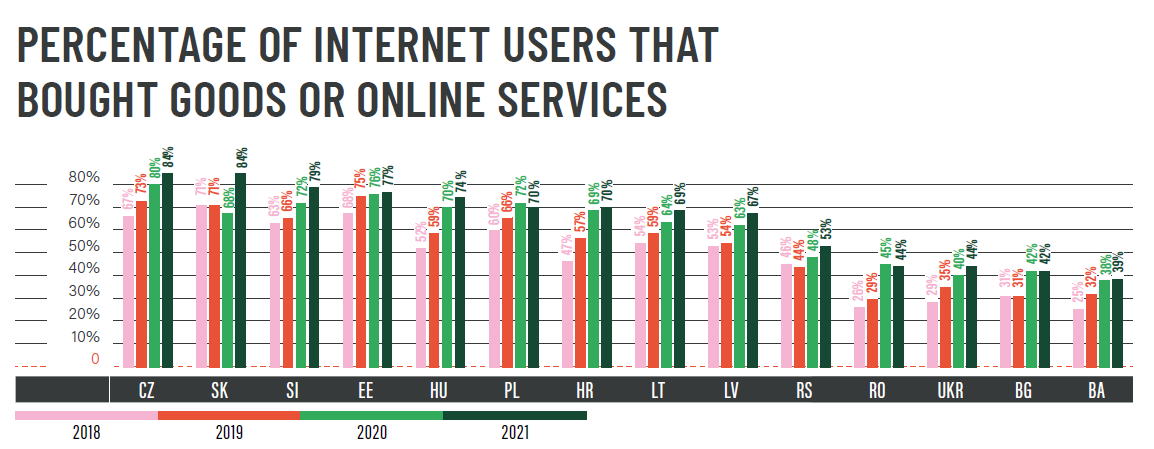

According to ecommerce-europe.eu (2021), the share of internet users purchasing goods online increased by 5%, and the growth rate of B2C e-commerce turnover in Central and Eastern Europe was higher than in Western Europe (18%, 16% and 12% respectively).

Consumer Trends After COVID

Media experts from weCAN identify five key consumer trends

in individual chapters of the CANual Report. Although these trends vary across countries, several strong, common themes can be clearly observed across the region.

Sustainability is the number one trend in the region. Advertisers’ actions are highly diversified — from packaging-free stores and circular fashion based on second-hand clothing to state-supported ecological programmes. Nutrition has also become part of the sustainability agenda, with growing popularity of plant-based diets, eco-products and “free-from” food categories.

Lockdowns generated or strengthened several consumer trends. Older age groups discovered the convenience of online shopping, while the expectations of younger consumers gave rise to q-commerce (quick commerce) with delivery times of 10–15 minutes.

The pandemic also intensified the phenomenon of digital nomads, increased demand for rural travel, working from holiday destinations and a simple desire to travel freely again.

Approaching Recession

According to regional spending data, advertising markets in Central and Eastern Europe have already recovered from the pandemic-driven downturn. However, the Russian invasion of Ukraine and the global energy crisis have increased the risk of a serious economic recession.

The full report is available for download at: https://wecan.net/cannual-report/