CEE ad spendings bouncing back after COVID

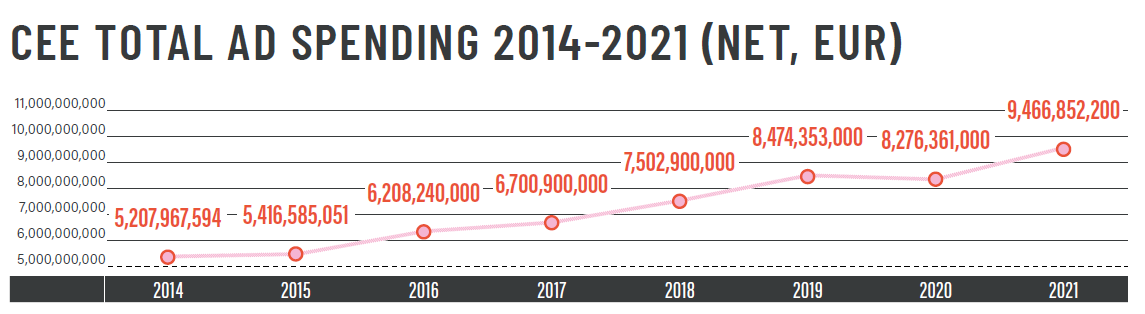

After a 2% drop in advertising spending, the Central and Eastern European markets have already surpassed their pre-COVID levels, reaching 9.5 billion Euros in 2021. The online segment is propelling the growth with a booming e-commerce, while numerous post-COVID consumer trends have formed throughout the region.

weCAN, the network of independent advertising agencies of Central and Eastern Europe recently published its 8th annual report called the CANnual Report. The report features the detailed analysis of advertising markets in 14 Central and Eastern European countries with focus on the effects of the COVID-19 pandemic in them. Besides compiling extensive data on the development of CEE’s media markets over the past year, weCAN experts provide with an overview of the most prominent topics in communications that shape advertising in the region. The report includes an article by guest author Dr. Árpád Rab, an expert of digital culture and a futurologist who describes from a historical viewpoint the impact of digital technologies on our lives, and how they will influence them in the next decade.

Bouncing back after the COVID-drop

Comparing to the economic performance of 2020, 2021 was a year of recovery: growing household consumption, rising wages and decreasing unemployment resulted in a 6% -GDP-growth on average. In the meantime, the political climate did not deteriorate: looking at the global score of the Democracy Index, it fell from 5.37 in 2020 to 5.28 in 2021, while the average score of the 14 CEE countries increased from 6.73 to 6.75.

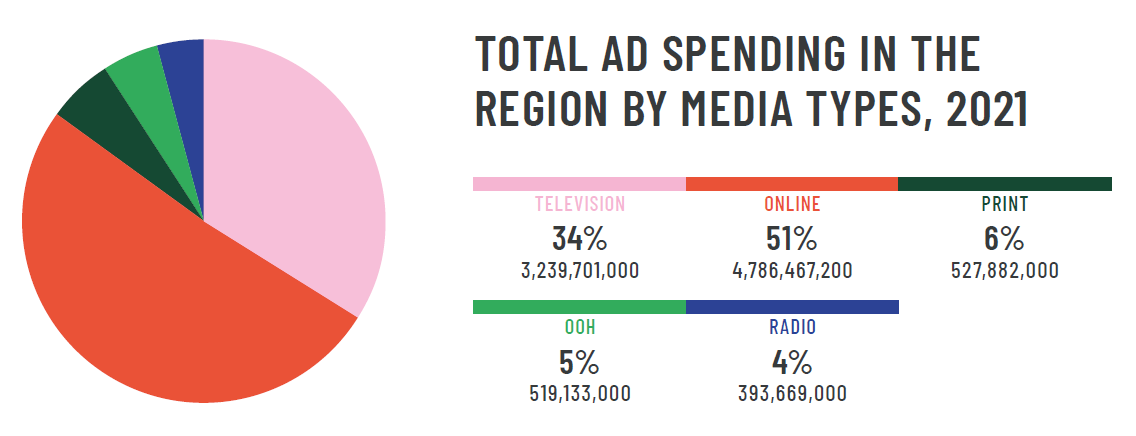

Among these favorable conditions, the advertising industry bounced back from the losses it had suffered during the pandemic: after a 2% drop in 2020, the regional market reached the volume of net 9.5 billion Euros, with a 14% growth. The main engine of this momentum was the digital segment that recorded an 18% growth, now taking up more than half of the overall advertising spending.

Though spendings grew in all main segments, the average share of media types follows a long-standing trend. Besides the perpetual expansion of online media, on average, television is still in the lead – slowly losing its share from year to year however –, print is in a constant and visible incline, and the outdoor and radio segments are keeping their position.

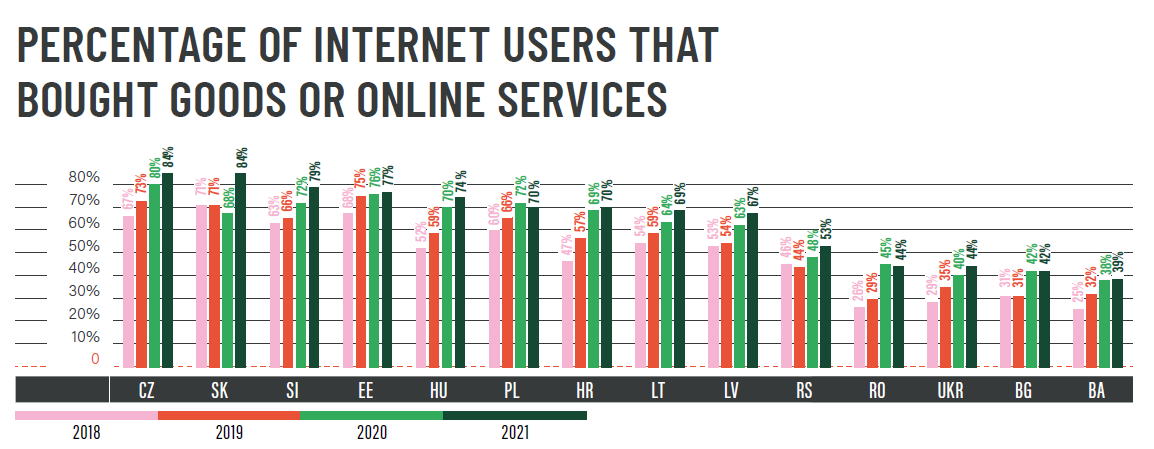

E-commerce proved to be an equally successful segment: according to ecommerce-europe.eu (2021), the percentage of internet users who bought goods online increased by 5%, and the growth-rate of B2C e-commerce turnover in Central and Eastern Europe was higher than in Western Europe (respectively 18%, 16% and 12%).

Post-COVID consumer trends

weCAN media experts list five of the most prominent consumer trends in their respective country chapters, and even though these appear in a great variety across the region, some major topics and trends are outlined in them.

Sustainability is number one within the new consumer behavior trends, ranging from no-packaging shops and pre-loved clothing to state-supported green home programs. A corresponding topic is nutrition: plant-based diet is gaining popularity along with organic goods and “free-from” foods are getting prominent as well. Particularly the lockdowns generated – or boosted – some of these consumer trends: e-commerce was discovered by older age-cohorts, and consumer expectations brought about Q-commerce: an abbreviation for quick commerce, meaning 10-15 minutes of delivery time. The pandemic accelerated the “digital nomad” trend, and in some cases, it can correspond to the increased demand for going rural, and the simple wish to be able to travel again re-popularized short-break destinations.

Looming recession

As seen from the regional spending figures, the CEE ad markets have already bounced back from the COVID-induced drop, however, with Russia’s war on Ukraine and the global energy crisis, the possibility of a serious recession is emerging.

The full report can be downloaded from www.wecan.net.